iowa state income tax calculator 2019

The calculator is updated for all states for the 2019 tax year. 2022 Tax Calculator Estimator - W-4-Pro.

State Tax Tables for 2019 displayed on this page are provided in.

. Your outstanding tax bill is estimated at 4244. Details of the personal income tax rates used in the 2022 Iowa State Calculator are published below the calculator this. Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator.

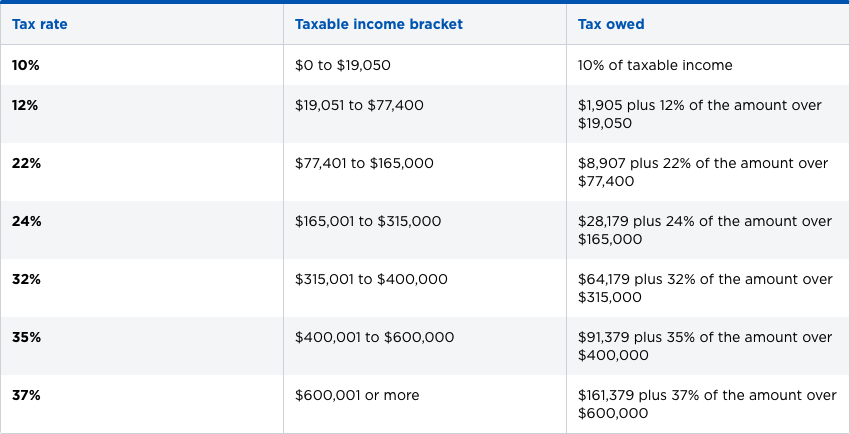

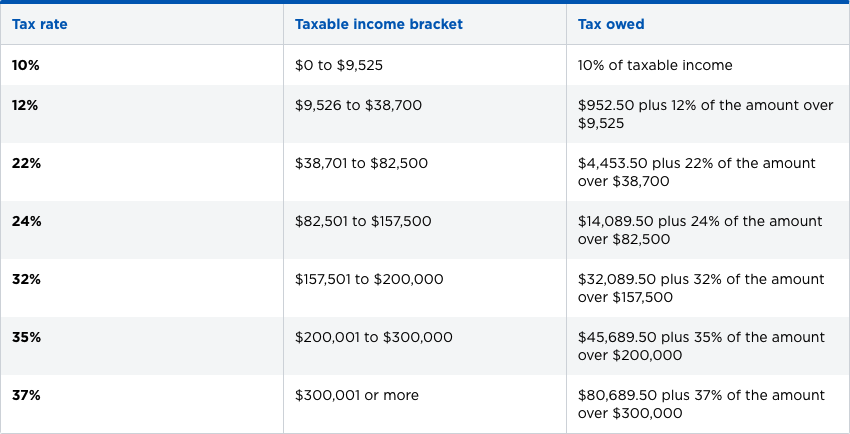

The provided information does not constitute financial tax or legal advice. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. The 2019 income tax brackets are as follows.

Iowa State Income Tax Forms for Tax Year 2021 Jan. The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income Tax Rates and Thresholds in 2022. After a few seconds you will be provided with a full breakdown of the tax you are paying.

The 2022 rates range from 0 to 75 on the first 34800 in wages paid to each employee in a calendar year. Enter your annual salary. Your taxes are estimated at 4244 Column Graph.

Iowa has a population of over 3 million 2019 and is the leading producer of corn in the world second to China. Nonresidents and Part-Year Residents. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

The Iowa Department of Revenue is responsible for publishing the latest Iowa State Tax. We strive to make the calculator perfectly accurate. Appanoose County has an additional 1 local income tax.

Find your pretax deductions including 401K flexible account contributions. This is 849 of your total income of 50000. Switch to Iowa hourly calculator.

2019 Iowa Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Using our free Iowa tax calculator can make figuring out how much you owe much easier. Your net income from all sources line 26 is 13500 or less and you are not claimed as a dependent on another persons Iowa return 32000 if you or your spouse is 65 or older on 123119. Fields notated with are required.

If line 66 is less than line 58 subtract line 66 from line 58 and enter the difference. For tax year 2019 the standard deduction is. How to Calculate 2019 Iowa State Income Tax by Using State Income Tax Table.

Iowa state income tax. Check the 2019 Iowa state tax rate and the rules to calculate state income tax. Contributed amount in 2019.

Resident of Appanoose countty need to pay 1 local income tax. Your household income location filing status and number of personal exemptions. Filing an Income Tax Return.

About Iowa income tax withholding. Please use the calculators report to see detailed calculation results in tabular form. So if you pay 2000 in Iowa state taxes and your school district surtax is.

Enter Your Tax Information. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. The Iowa State Tax Calculator IAS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year.

Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents. In addition to the exemption provisions above if you were a nonresident or part-year resident and had net income. If the amount you owe line 70 is large you may wish to check the Withholding Calculator to estimate your recommended withholding.

Find your income exemptions. Your taxes are estimated at 4244. You can quickly estimate your Iowa State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Iowa and.

0 033 x 0. The median household income is 58570 2017. Leave it blank if you dont have itemized deduction.

As of 2019 Iowas state income taxes range from 033 to 853 depending on income bracket. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Idaho State Tax Quick Facts.

Find your gross income. The income tax rate ranges from 033 to 853. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Contributed amount in 2019. Ad Free Tax Calculator. As an employer in Iowa you have to pay unemployment insurance to the state.

The Iowa State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Iowa State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The personal exemption was eliminated starting in the 2019 tax year just as they. By calculating your estimated tax you can.

Enter other state and local income taxes not including Iowa state income taxes on line 4a OR general sales taxes on line 4b as allowed on the federal form 1040 Schedule A line 5a. Tax season officially begins the same day as Federal return processing January 24 2022 and tax Iowa tax returns are due May 2. Enter those data which can reduce your tax liability.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. See What Credits and Deductions Apply to You.

Your total tax payments for the year were 0. If youre a new employer congratulations you pay a flat rate of 1. Filing Made Easy provides a quick look at the process of filing an Iowa income tax return including Common Mistakes to avoid.

So exactly how much is Iowa state tax. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. 54-130a - Iowa Rent Reimbursement Claim.

New construction employers pay 75. IA 1040 - Iowa Individual Income. Create Your Account Today to Get Started.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Federal Income Tax Brackets Brilliant Tax

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The Freest States For Off Grid Living Ranked 1 50 Off Grid Homestead Going Off The Grid Off The Grid

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Tax Calculator Estimate Your Taxes And Refund For Free

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Iowa Tax Law Makes Some Changes Now But Others Are Far Off And Contingent Center For Agricultural Law And Taxation

How The Tcja Tax Law Affects Your Personal Finances

How To Fill Out A Fafsa Without A Tax Return H R Block

2019 State Income Tax Rates Credit Karma Tax

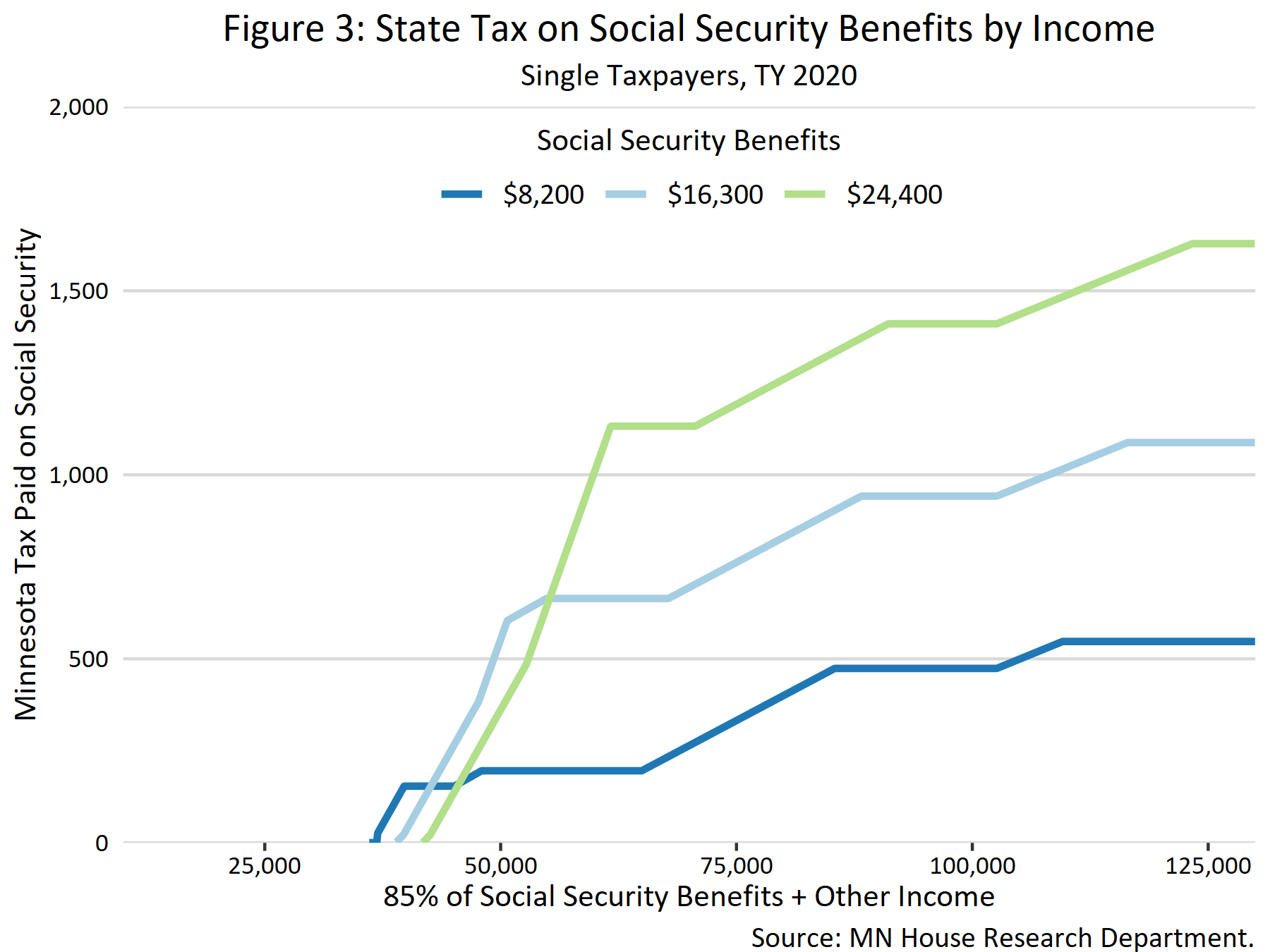

Taxation Of Social Security Benefits Mn House Research

Federal Income Tax Brackets Brilliant Tax

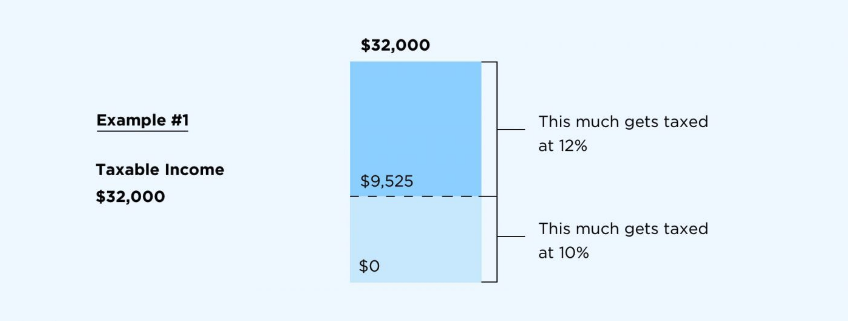

Federal Income Tax Brackets Brilliant Tax

Federal Income Tax Brackets Brilliant Tax

Tax Information Arizona State Retirement System

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How The Tcja Tax Law Affects Your Personal Finances

5 Form 5 Pdf 5 Things You Won T Miss Out If You Attend 5 Form 5 Pdf